August is my least favorite month. It’s hot and it’s been hot for several months. Waiting for cooler weather is basically like waiting for Christmas.

Fortunately, on the financial front, August was a productive month. Although some spending was over budget, we were able to reduce some expenses and also save money for large upcoming items.

Our actual grocery/household spending of $1,545 exceeded our $1200 budget substantially, but we were able to keep our restaurant spending to only $295.

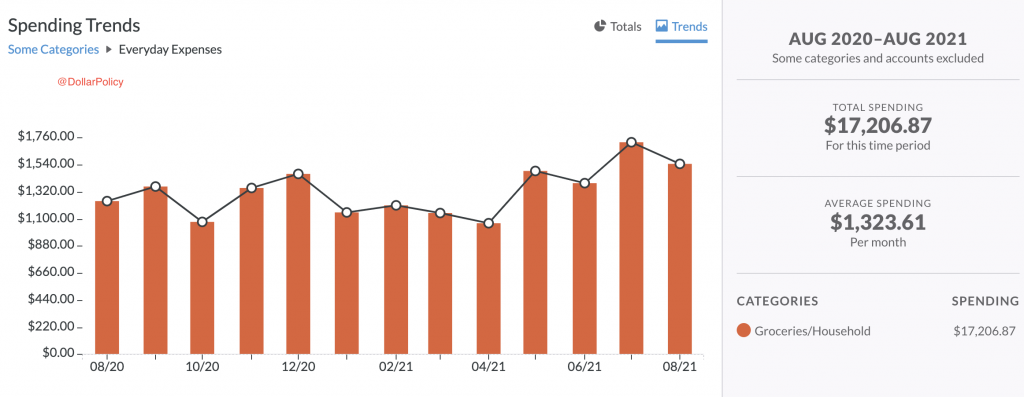

Grocery Spending. Difficult to control.

It’s kind of difficult to determine the cause of our grocery/spending. We’re off by about $345, which is about 1-2 big grocery runs. We did make a Costco run in August, which was about $270. We continued our Hello Fresh experiment but only at an August cost of $136.56. There are several regular grocery orders that seem to average a bit higher cost than usual. Some of this is probably due to buying snacks and school lunches for my kids who went back to school in August. Ultimately, it seems that we simply need to plan a bit better and deny ourself or our kids certain items. Or just simply go to the grocery store a bit less. Below is a helpful YNAB report showing our grocery/household spending since August of 2020. You can see that there were some good months earlier this year but spending has crept up in last 4 months.

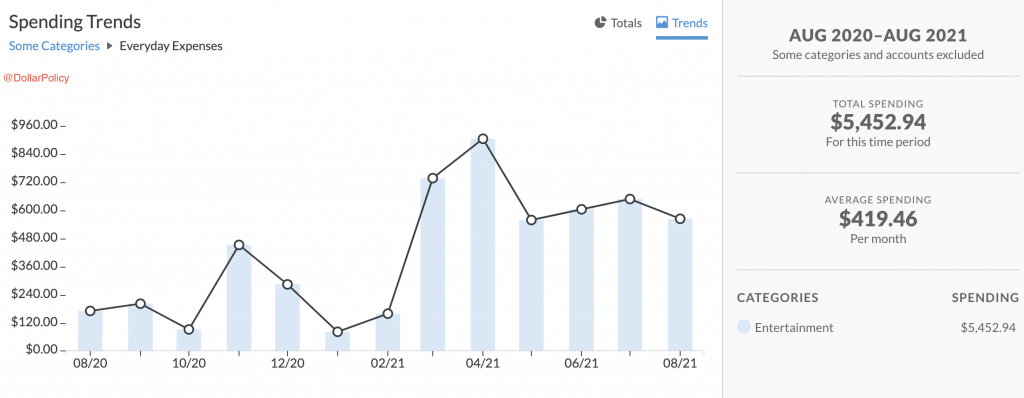

We spent $270 on gas, $382 on clothing, $193 on medical, and only $50 on childcare. All of these are close to the average over the last several months. Our miscellaneous and entertainment budget at ($535 and $563) seem a bit high.

Good Budget Concepts

Before we get to entertainment, a quick note on productive budget concepts. A lot of people will make the mistake of budgeting too restrictively. Or they will have so many budget categories it’s impossible to learn anything from the data. Consider your real life. Don’t try to budget $0 for entertainment or $20/month for food. That’s simply not sustainable and will likely cause you to quit budgeting entirely when you fail. You are going to want to do fun things and spend money. You need an entertainment budget category. and a catch-all category for things you forgot or that only come up on rare occasions.

For example, our August miscellaneous spending includes $220 for passport renewals. It would make no sense to have a budget for passports since it comes up every 10 years. This is miscellaneous spending. Now, back to entertainment. As you can see below, we clearly like to have some fun as we have kicked up our entertainment spending over the last several months per our YNAB report below.

Note that I use my entertainment budget as an overflow for restaurant spending and for cash withdrawals. If I need cash, I withdrawal cash and categorize the cash as entertainment. The cash will be spent on fun things like fast food or other “entertainment”.

Saving for the future.

We saved $1000 for Christmas and paid $522 for our portion of a vacation deposit for summer 2022. My entire side income has been allocated for our car replacement fund, which is now up to $2800. We continue to contribute $225 total to a college savings account for our kids.

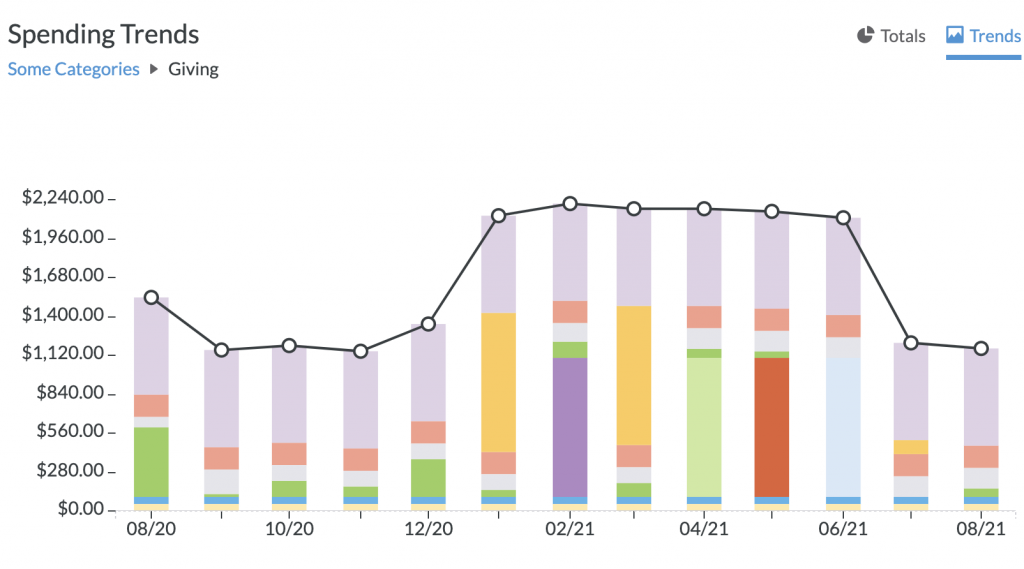

Giving.

We donated approximately $1160 in August. This includes all of our standard automatic monthly giving. Unfortunately, we did not give our extra $1000 in August or July. fact, I had to move the July allocation of $1000 to other spending/saving priorities in August. There is so much need, but I think we must build our cash position to be ready to be prepared to make a career move and/or buy a new family car.

Rental Account.

Our rental account continues to generate cash. At August month-end, we have about $4200 in our rental account. I’d prefer to let this fund build up over time and use it on a big purchase of potentially another rental property or for our Roth IRA. My spouse would prefer to give some of it away. It’s a typical conundrum and conversation in our house. As of August, we are simply holding tight.

Conclusion

Overall, August was a productive month. We bolstered our cash/savings position and made progress on saving for the future. Hopefully, we will make further progress over the next few months by spending more intentionally and continuing to growing our income.